In today's dynamic business landscape, managing payroll for small businesses with remote teams has become increasingly crucial. From choosing the right software to implementing effective systems, this guide covers everything you need to know about the best payroll solutions for small business owners with remote teams.

Features of a Good Payroll System for Small Businesses with Remote Teams

Managing payroll for remote teams in small businesses requires specific features to ensure efficiency and accuracy. Here are key features that are essential for a good payroll system:

Automation for Streamlined Processes

Automation plays a crucial role in streamlining payroll processes for small businesses with remote teams. By automating tasks such as time tracking, calculating wages, and generating reports, businesses can save time and reduce errors.

Cloud-Based Access

- Cloud-based access allows remote employees to easily submit their timesheets and access pay stubs from anywhere, ensuring seamless communication and transparency.

Integration with Accounting Software

- Integrating payroll systems with accounting software such as QuickBooks or Xero can help small businesses maintain accurate financial records and simplify tax filing processes.

Employee Self-Service Portal

- An employee self-service portal enables remote team members to update their personal information, view their pay history, and download important documents without the need for constant back-and-forth communication with HR.

Factors to Consider When Choosing a Payroll System for Small Businesses with Remote Teams

When selecting a payroll system for a small business with remote teams, several key factors need to be taken into consideration to ensure smooth operations and compliance with regulations.

Importance of Scalability

Scalability is crucial when choosing a payroll system for small businesses with remote teams, especially for those experiencing growth. The system should be able to accommodate an increasing number of employees, handle more complex payroll processes, and integrate with other business systems as the company expands.

Pricing Structures and Suitability

Comparing pricing structures of different payroll systems is essential for small businesses with remote teams. Some systems may offer a flat fee per employee, while others may charge based on the number of users or features utilized. It is important to choose a system that aligns with the budget of the business and provides the necessary functionalities without unnecessary costs.

Compliance with Tax Regulations

Ensuring compliance with tax regulations is paramount for small businesses with remote teams. A good payroll system should automatically calculate taxes, deductions, and contributions accurately, keeping up with the ever-changing tax laws and regulations. Non-compliance can lead to penalties, fines, and legal issues that can be detrimental to the business.

Best Payroll Software Options for Small Business Owners with Remote Teams

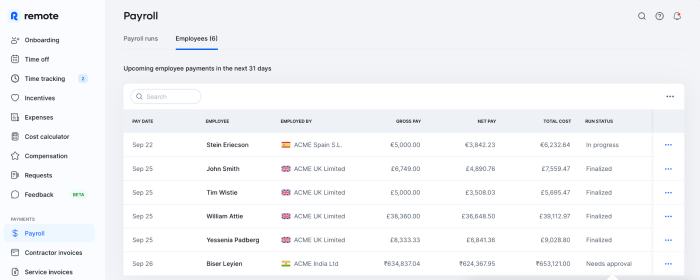

When it comes to managing payroll for small businesses with remote teams, having the right software can make a significant difference in efficiency and accuracy. Let's explore some popular payroll software solutions tailored for small businesses with remote teams.

Comparison of Popular Payroll Software Solutions

- QuickBooks Online Payroll: Known for its user-friendly interface and seamless integration with accounting software, QuickBooks Online Payroll is a popular choice for small business owners. It offers features like automatic payroll calculations, tax filing, and direct deposit.

- Gusto: Gusto is another top-rated payroll software ideal for small businesses with remote teams. It offers easy setup, automated tax calculations, and compliance with federal and state regulations. Gusto also provides employee self-service portals for easy access to pay stubs and tax forms.

- ADP Run: ADP Run is a comprehensive payroll solution that caters to businesses of all sizes. It offers features like payroll processing, tax compliance, and time tracking. ADP Run also provides dedicated customer support for any payroll-related queries.

User-Friendly Payroll Software for Non-Tech Savvy Small Business Owners

For small business owners who are not tech-savvy, user-friendly payroll software is essential. QuickBooks Online Payroll stands out as a great option due to its intuitive interface and step-by-step guidance for payroll processing

Customer Support Options from Payroll Software Providers

Different payroll software providers offer varying levels of customer support for small businesses with remote teams. Gusto, for example, provides phone and email support along with a comprehensive help center. ADP Run offers dedicated account managers and live chat support to address any payroll-related issues promptly.

Tips for Implementing a Payroll System for Small Businesses with Remote Teams

Implementing a new payroll system for remote teams can be a daunting task, but with the right approach, it can streamline your payroll processes and improve efficiency. Here are some tips to help you effectively transition to a new payroll system for your small business with remote teams.

Step-by-Step Guide for Implementation

- Assess your needs and research different payroll systems to find the best fit for your small business.

- Set up the new payroll system with the help of a dedicated team or payroll provider.

- Ensure all employee information is accurately inputted into the system for seamless payroll processing.

- Conduct thorough testing to identify any issues and make necessary adjustments before going live.

- Provide training to your remote team on how to use the new payroll system effectively.

Best Practices for Training Employees

- Offer comprehensive training sessions through video conferences or screen-sharing tools to ensure remote employees understand the new payroll system.

- Create user manuals or video tutorials for easy reference on how to navigate the payroll system and troubleshoot common issues.

- Assign a point of contact or support team to address any questions or concerns from employees during the transition period.

Importance of Data Security and Backup Measures

- Implement strict access controls and encryption protocols to protect sensitive payroll data from unauthorized access.

- Regularly back up payroll information to secure cloud storage or an external server to prevent data loss in case of system failures or cyberattacks.

- Conduct regular security audits and updates to ensure your payroll system is up-to-date with the latest security measures and compliance standards.

Final Summary

As we wrap up our discussion on the best payroll solutions for small business owners with remote teams, it's clear that adopting the right system can streamline processes, ensure compliance, and support the growth of your business. Stay informed, stay efficient, and watch your business thrive in the digital age.

Quick FAQs

What are the key features of a good payroll system for small businesses with remote teams?

Key features include cloud-based accessibility, automated calculations, and integration with time tracking tools.

Why is scalability important when choosing a payroll system for small businesses with remote teams?

Scalability ensures that the system can grow with your business as you add more remote team members.

How can businesses ensure compliance with tax regulations in their payroll system?

Regular updates and adherence to tax laws, along with accurate reporting, are essential for compliance.