Delving into the realm of payroll management, the contrast between using a Payroll Company for Small Business and implementing an In-House Payroll System unveils intriguing insights. This comparison sheds light on the nuances and benefits that each option offers, guiding small business owners towards informed decisions.

Introduction to Payroll Systems

Payroll systems are essential tools used by businesses to manage employee compensation, including salaries, wages, bonuses, and deductions. These systems automate the process of paying employees and ensure accurate and timely payments.

Key Components of a Payroll System

- Employee Information: Includes details such as name, address, tax withholdings, and bank account information.

- Time and Attendance Tracking: Monitors employee work hours, overtime, and attendance to calculate accurate payments.

- Payroll Processing: Calculates wages, taxes, deductions, and net pay for each employee based on hours worked and other factors.

- Tax Filing and Compliance: Ensures that payroll taxes are accurately calculated, withheld, and reported to the government.

- Reporting: Generates reports on payroll expenses, employee earnings, tax liabilities, and other relevant data for analysis.

Importance of an Efficient Payroll System for Small Businesses

An efficient payroll system is crucial for small businesses to maintain compliance with tax laws, avoid costly errors, and save time and resources. By automating payroll processes, small businesses can streamline operations, reduce the risk of penalties, and improve overall financial management.

Benefits of Using a Payroll Company

Outsourcing payroll to a company can bring numerous benefits to small businesses. Not only does it save time and reduce errors, but it can also be a cost-effective solution compared to maintaining an in-house payroll system.

Time-Saving

- A payroll company handles all aspects of payroll processing, from calculating wages to issuing paychecks, saving small business owners valuable time.

- By outsourcing payroll tasks, business owners can focus on core operations and strategic planning, enhancing overall productivity.

- Payroll companies stay up-to-date with tax regulations and compliance requirements, ensuring accuracy and timely processing.

Reduced Errors

- Professional payroll providers have the expertise and tools to minimize errors in payroll calculations and tax filings, reducing the risk of costly mistakes.

- Automated payroll systems used by payroll companies help streamline processes and eliminate manual errors that can occur with in-house payroll systems.

Cost Comparison

- While there is a cost associated with outsourcing payroll services, the overall savings in time and resources can outweigh the expense.

- Using a payroll company can eliminate the need to hire and train dedicated payroll staff, reducing payroll-related labor costs for small businesses.

- Additionally, payroll companies can help avoid costly penalties and fines that may arise from payroll errors or non-compliance with tax regulations.

Challenges of Using a Payroll Company

When it comes to outsourcing payroll services to a company, there are several challenges that small businesses may encounter. It's important to be aware of these potential drawbacks before making a decision.

Data Security Concerns

Outsourcing payroll to a third-party company means sharing sensitive employee information and financial data. This raises concerns about data security and the risk of data breaches. Small businesses need to ensure that the payroll company has robust security measures in place to protect this confidential information.

Potential for Errors

Another challenge of using a payroll company is the potential for errors in payroll processing. Mistakes in calculating wages, taxes, or other deductions can lead to compliance issues and financial discrepancies. Small businesses must closely monitor the accuracy of the payroll services provided by the company.

Lack of Control

By outsourcing payroll, small businesses give up some control over the process. They may have limited flexibility in customizing payroll reports or handling unique payroll situations. This lack of control can be frustrating for businesses that prefer a hands-on approach to managing their payroll.

Cost Considerations

While outsourcing payroll can save time and resources, it also comes with a cost. Small businesses need to weigh the fees charged by payroll companies against the benefits of outsourcing. In some cases, the expense of using a payroll company may not be justifiable for businesses with limited financial resources.

Communication Challenges

Effective communication is essential when working with a payroll company. Misunderstandings or delays in communication can lead to errors in payroll processing. Small businesses need to establish clear lines of communication with the payroll company to ensure smooth operations and timely payroll services.

In-House Payroll Systems

An in-house payroll system refers to the process of managing payroll internally within a company, using the organization's own resources and software to handle payroll tasks.

Setting Up an In-House Payroll System

Setting up an in-house payroll system involves several key steps to ensure accurate and efficient payroll processing:

- Acquire payroll software or develop a customized payroll system to suit the company's specific needs.

- Set up employee profiles within the system, including personal information, tax details, salary, and benefits.

- Establish a payroll schedule outlining pay periods, payment dates, and deadlines for submitting payroll information.

- Ensure compliance with tax laws and regulations by staying updated on payroll tax requirements and reporting obligations.

- Train staff or assign dedicated personnel to manage payroll tasks, such as processing payroll, calculating taxes, and generating pay stubs.

Advantages of Managing Payroll In-House

Managing payroll in-house offers several advantages for small businesses:

- Cost savings: By handling payroll internally, companies can save on outsourcing fees associated with third-party payroll services.

- Control and customization: In-house payroll systems provide greater control over payroll processes and allow for customization to meet specific business needs.

- Confidentiality and security: Keeping payroll data in-house can enhance data security and ensure confidentiality of sensitive employee information.

- Quick response to changes: Internal payroll systems enable businesses to quickly address any payroll-related issues or changes without relying on external providers.

- Increased knowledge and expertise: Managing payroll internally can help businesses gain a better understanding of their payroll processes and develop expertise in-house.

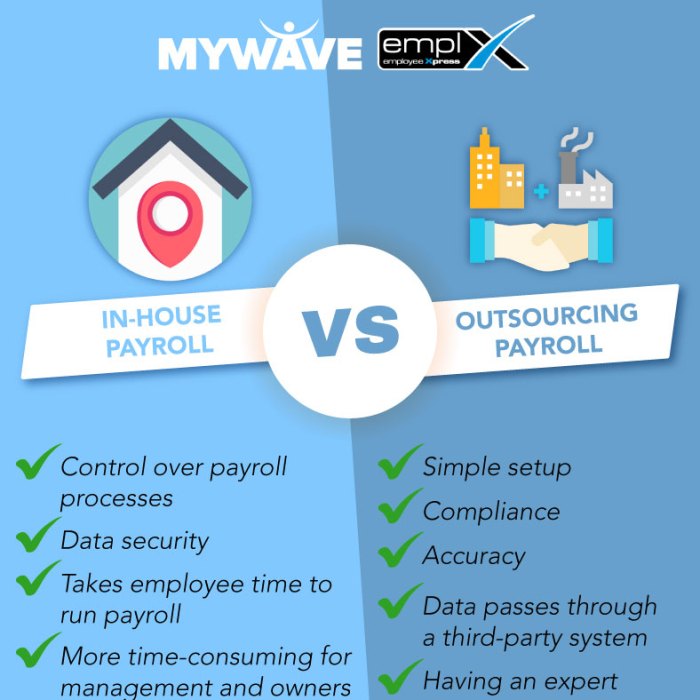

Comparison between Payroll Company and In-House Systems

When it comes to managing payroll, small businesses have two main options: using a payroll company or managing it in-house. Each option comes with its own set of advantages and challenges. Let's compare the level of control, scalability, and customization options offered by both payroll companies and in-house systems.

Level of Control

With an in-house payroll system, small businesses have full control over all aspects of payroll processing. They can customize the system to suit their specific needs, make immediate changes when necessary, and ensure that sensitive payroll data is kept in-house.

On the other hand, using a payroll company means relinquishing some control over the process. While the company will handle the day-to-day tasks, businesses may have limited control over the timing and specifics of payroll processing.

Scalability for Small Businesses

When it comes to scalability, in-house payroll systems may require additional resources as the business grows. Small businesses may need to invest in software upgrades, hire more staff, or allocate more time to manage payroll internally. Payroll companies, on the other hand, offer scalable solutions that can easily accommodate business growth.

They have the expertise and resources to handle increased payroll needs without placing additional burden on the business.

Customization Options

In-house payroll systems provide small businesses with a high level of customization. They can tailor the system to meet specific requirements, integrate it with other internal processes, and make changes as needed. Payroll companies, while efficient, may offer limited customization options.

Businesses may have to adapt their processes to fit the payroll company's system, leading to potential limitations in customization.

Compliance and Regulations

When it comes to payroll processing, small businesses must adhere to various compliance requirements to avoid legal issues and penalties. These requirements include tax regulations, labor laws, and reporting obligations.

Compliance with a Payroll Company

A payroll company ensures compliance by staying up-to-date with changing regulations, processing payroll accurately and on time, and providing necessary documentation for audits. They have experts who understand the complexities of payroll laws and can help small businesses navigate them effectively.

Challenges of In-House Payroll Compliance

Staying compliant with an in-house payroll system can be challenging for small businesses. They need to invest time and resources in training staff, keeping track of regulatory changes, and ensuring accurate payroll calculations. Mistakes in compliance can lead to fines and legal issues, putting the business at risk.

Integrations and Reporting

When it comes to payroll systems, integrations and reporting play a crucial role in streamlining processes and ensuring accurate data management. Let's delve into the integration capabilities of payroll companies with other systems and explore the reporting features offered by them.

Integration Capabilities of Payroll Companies

Payroll companies often offer seamless integrations with various systems such as HR software, accounting software, time and attendance tracking tools, and benefits administration platforms. This integration allows for the automatic transfer of data between different systems, reducing manual data entry errors and saving time.

Reporting Features Offered by Payroll Companies

Payroll companies provide robust reporting features that allow businesses to generate various reports such as payroll summaries, tax filings, employee earnings statements, and labor distribution reports. These reports can be customized to meet specific business needs and can provide valuable insights into payroll expenses and employee compensation.

Comparison of Reporting Capabilities

In-house payroll systems may offer basic reporting functionalities, but they often lack the advanced features and customization options provided by payroll companies. Payroll companies typically have sophisticated reporting tools that offer more in-depth analysis, compliance reporting, and forecasting capabilities. This gives businesses a comprehensive view of their payroll data and helps them make informed decisions.

Ending Remarks

In conclusion, the choice between a Payroll Company for Small Business and an In-House Payroll System is pivotal for streamlined operations and financial efficiency. Understanding the pros and cons of each avenue empowers businesses to navigate the complex landscape of payroll management with confidence and clarity.

Q&A

What are the key components of a payroll system?

The key components include employee information, salary details, tax deductions, and payment schedules.

How can a payroll company save time for small businesses?

By handling payroll processing, tax calculations, and compliance tasks efficiently, freeing up time for business owners to focus on other operations.

What are the potential drawbacks of relying on a payroll company?

Potential drawbacks include loss of control over sensitive data, dependency on external services, and additional costs.

How do payroll companies ensure compliance with regulations?

Payroll companies stay updated on changing regulations, conduct regular audits, and implement secure processes to maintain compliance.

What customization options are available with in-house payroll systems compared to payroll companies?

In-house payroll systems allow businesses to tailor processes, reports, and calculations to their specific needs, offering more flexibility compared to standard payroll services.